2021后疫情時代中國保險業創新大會

- 2020年10月14日

- 16:29

- 來源:

- 作者:

2020 is a very difficult year. The sudden outbreak of COVID-19 pandemic worldwide has caused the sharpest economic contraction since the great recession of 1930s, which will lead to a slump in demand for insurance in 2020. It’s anticipated that global insurance premiums will contract by 3.8% in 2020, with life insurance covers down by 4.4% and P&C insurance by 2.9%. While the recession will also be short-lived as the world will gradually recover from the pandemic. Once the world recovers in 2021, global premiums growth should settle at 44% over the next decade, driven by Asia with China at the front.

2020年是異常艱難的一年。新冠疫情在全球范圍內的大爆發引起了三十年代大蕭條以來最大幅度的經濟下滑,保險需求也急劇降低。預計2020年全球總保費將下降3.8%,其中壽險下降4.4%,財險下降2.9%。但是衰退將是短暫的,全球將逐步從疫情中恢復。一旦2021年世界經濟復蘇,在亞洲的推動下,未來十年全球保費將實現4.4%的增長。中國依然是增長的引擎。

The Insurance Innovation post COVID-19 Conference China 2021 is the largest gathering in China focusing on insurance transformation in the post COVID-19 era and will gather the whole industry players to explore the current and future impacts of COVID-19 and find the ways out for recovery and prosperity.

2021后疫情時代中國保險業創新大會是中國最大規模聚焦后疫情時代保險業發展的高端峰會,將匯聚全行業共同探討疫情的短期和中長期影響以及尋找后疫情時代中國保險業的復蘇與繁榮之路。

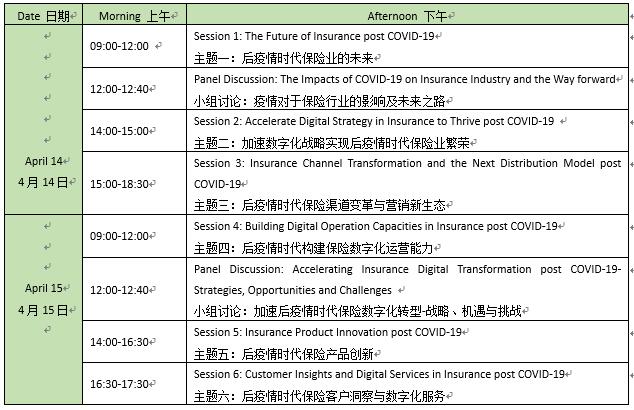

會議時間:4月14-15日|會議地點:中國上海

. Focusing on China insurance transformation and innovation post COVID-19

聚焦后疫情時代中國保險業轉型與創新

. The largest conference in China on insurance innovation post COIVD-19

中國最大規模后疫情保險創新峰會

. Sharing Global and local insights

分享國內外觀點

. Exploring how COVID-19 drives insurance industry to accelerate digital, innovate products, update distribution, optimize operation and engage with customers to recover and thrive

探討疫情如何倒逼保險業加速數字化、創新產品、變革營銷、優化運營、洞察客戶以實現復蘇與繁榮

. More than 300+ high level attendees

300+高層參會嘉賓

. What are the impacts of COVID-19 on insurance industry in the short, medium and long term?

疫情對于保險業短期及中長期有哪些影響?

. How can Insurance to recover from the crisis the soonest?

保險業應如何盡快從疫情中恢復?

. How should insurance to innovate and transform to thrive in the future?

保險業應如何創新與轉型以實現未來的繁榮?

. How to innovate insurance channels and build next distribution model post COVID-19?

后疫情時代如何創新保險渠道和構建營銷新生態?

. How to accelerate digital strategies and transformation in insurance post COVID-19?

后疫情時代如何加速保險數字化戰略與數字化轉型?

. How to diversify insurance business portfolios post COVID-19 to meet the changing needs?

后疫情時代如何豐富保險產品以適應變化的需求?

. How to build agile and digital operation capabilities in insurance post COVID-19?

后疫情時代險企如何構建靈敏和數字化的運營能力?

. How to develop customer insights and innovate customer experience post COVID-19?

后疫情時代如何洞察客戶,創新客戶體驗?

. How technologies and insurtech will enable insurance transformation post COVID-19?

后疫情時代科技和保險科技將如何賦能保險轉型?

. How should insurance agents and brokers to innovate to survive and grow in the new normal?

保險代理與經紀應如何創新以實現新常態下的生存與發展?

?

?

. The Future of Insurance post COVID-19

后疫情時代保險業的未來

. The Impacts of COVID-19 on Global Insurance Industry

新冠疫情對全球保險業的影響

. Pursuing COVID-19 Insurance Recoveries in China

推動后疫情時代中國保險業復蘇

. Responding to COVID-19 with Digital Solutions and Innovation

數字化方案與創新應對新冠疫情

. The Road of Insurance in the post COVID-19 Era

后疫情時代的保險業之路

. InsurTech to Enable Insurance Recovery and Boom in the New Normal

保險科技助力新常態下保險業復蘇與繁榮

. Accelerate Digital Strategy in Insurance to Thrive post COVID-19

加速數字化戰略實現后疫情時代保險業繁榮

. Digital Strategy and Blueprint of Insurance post COVID-19

后疫情時代的保險數字化戰略與布局

. How should Insurers Embrace and Speed up Digital post COVID-19

后疫情時代保險公司應如何擁抱和加速數字化

. Insurance Channel Digital Transformation post COVID-19

后疫情時代保險渠道數字化轉型

. The Next Distribution Model in Insurance post COVID-19

后疫情時代保險營銷新生態

. Live Commerce, Fan Economy and Innovation of Insurance Distribution

直播帶貨、粉絲經濟與保險營銷創新

. AI and Big Data Make Insurance Distribution Smarter

人工智能與大數據讓保險營銷更智能

. How COVID-19 Reshapes Insurance Agent

疫情如何重塑保險代理

. Building Digital Operation Capacities in Insurance post COVID-19

后疫情時代構建保險數字化運營能力

. Digital Pricing for post-COVID-19 Transformation

后疫情轉型之數字化定價

. Digital and AI Power Underwriting in post COVID-19 Insurance

后疫情時代數字化與人工智能賦能保險承保

. How COVID-19 has Boosted Innovation in Insurance Claims

疫情如何促進保險理賠創新

. New Opportunities for Small and Medium Sized Insurers post COVID-19

后疫情時代中小型險企的新機遇

. Insurance Product Innovation post COVID-19

后疫情時代保險產品創新

. Changes of Customer Needs Emerging in China post COVID-19 Insurance Market

后疫情時代中國保險市場客戶需求變化

. The Impacts of COVID-19 on Life Insurance and Annuity Products

疫情對壽險與年金險產品的影響

. COVID-19 Spurs Innovation in Health Insurance & Long Term Medical Insurance

疫情推動健康險產品與長期醫療保險創新

. The Changes of Needs of P&C Insurance Products and Innovation Trends post COVID-19

后疫情下財產險產品需求變化與創新趨勢

. Customer Insights and Digital Services in Insurance post COVID-19

后疫情時代保險客戶洞察與數字化服務

. How COVID-19 Accelerates the Digitalization of the Insurance Customer Journey

疫情如何加速保險客戶旅程數字化

. Telehealth to Expand Access to Essential Health Services

互聯網醫療擴大基本醫療服務的可獲得性

閱讀排行榜

-

1

IHIC2024中國健康保險創新發展大會在上海圓滿落幕!

-

2

“數智軟件提升新質”——2024中國軟件技術大會召開在即

-

3

IHIC健康險創新發展大會即將召開

-

4

精英匯聚,共促保險業繁榮發展,2024第十二屆中國保險產業國際峰會圓滿收官

-

5

2024年INSight金融洞察力峰會:洞察未來,北京點金!

-

6

倒計時兩周!誠邀您參與9月20日上海2024第十二屆中國保險產業國際峰會

-

7

第十六屆InsurDigital未來保險峰會

-

8

第六屆中國保險業數字化與人工智能發展大會2024暨“金保獎”頒獎典禮在滬圓滿落幕

-

9

“2024中國壽險&財險科技應用高峰論壇”特邀報告——IFRS17下的保險業務參考模型變革

-

10

IHIC健康險創新發展大會

推薦閱讀

-

1

華泰人壽高管變陣!友邦三員大將轉會鄭少瑋擬任總經理即將赴任業內預計華泰個險開啟“友邦化”

-

2

金融監管總局開年八大任務:報行合一、新能源車險、利差損一個都不能少

-

3

53歲楊明剛已任中國太平黨委委員,有望出任副總經理

-

4

非上市險企去年業績盤點:保險業務收入現正增長產壽險業績分化

-

5

春節前夕保險高管頻繁變陣

-

6

金融監管總局印發通知要求全力做好防汛救災保險賠付及預賠工作

-

7

31人死亡!銀川燒烤店爆炸事故已排查部分承保情況,預估保險賠付超1400萬元

-

8

中國銀保監會發布《關于開展人壽保險與長期護理保險責任轉換業務試點的通知》

-

9

2024年新能源商業車險保費首次突破千億元

-

10

連交十年保險卻被拒賠?瑞眾保險回應:系未及時繳納保費所致目前已妥善解決